Where’s all the shadow inventory everyone keeps talking about? Many economists speculate that we will continue to see depreciation in the housing market due to the fact that there are still millions of homes that have been foreclosed upon that the banks still need to liquidate.

Then why aren’t we seeing these homes come on the market? Because some of the biggest banks with the most foreclosed inventory are considering selling these properties in large blocks to major financial investors. Yup, that means these homes may NEVER come on the open market! Good for housing values, bad for first time home buyers.

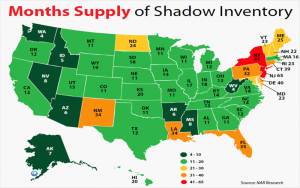

So what if these houses EVENTUALLY come on the market? Seattle home values will continue to free fall, right? Not necessarily. The MILLIONS of homes that still need to be sold are on a NATIONAL level. To figure out how this will affect the greater Seattle area, we need to look at LOCAL statistics.

So how many foreclosed Seattle homes are there? Many media sources have been reporting that we still have around 4 years of foreclosed inventory to be sold! But these numbers are a lot closer to 4 months on a local level. This is a DRASTIC difference! Six months of inventory is considered to be healthy housing market, where neither buyers nor sellers have leverage over one another.

So even if all this shadow inventory does come on the Seattle Market, it still probably WON’T swing things back to a buyer’s market. And in any case, that’s still a big if. In many Seattle neighborhoods we’ve seen a 50% decline in available inventory, and this may not get any better.

So are home prices going back up in the greater Seattle area? Yup, and if inventory levels as well as other factors continue to swing in the sellers favor, this appreciation may continue. But it’s not to late! At the moment, many areas are still seeing values that we haven’t seen since 2001, and don’t forget rates are still at all time lows.

If you’re thinking about buying your first home in the greater Seattle area, don’t make a decision without getting educated! Go to our Calendar/Reservations page and sign up for one of our FREE First Time Home Buyer Workshops.